charitable gift annuity rates

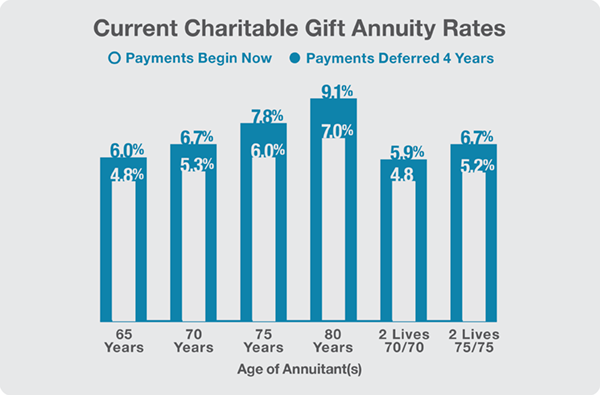

She will receive annual payments of 1550 a rate of 62. Single Life Charitable Annuity Rates by Age For example if you created a 100000 gift annuity at age 70 you could expect to receive 4700 in payments each year.

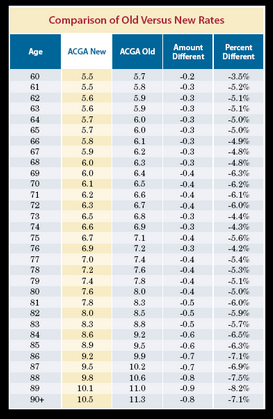

Acga Lowers Gift Annuity Rates Sharpe Group

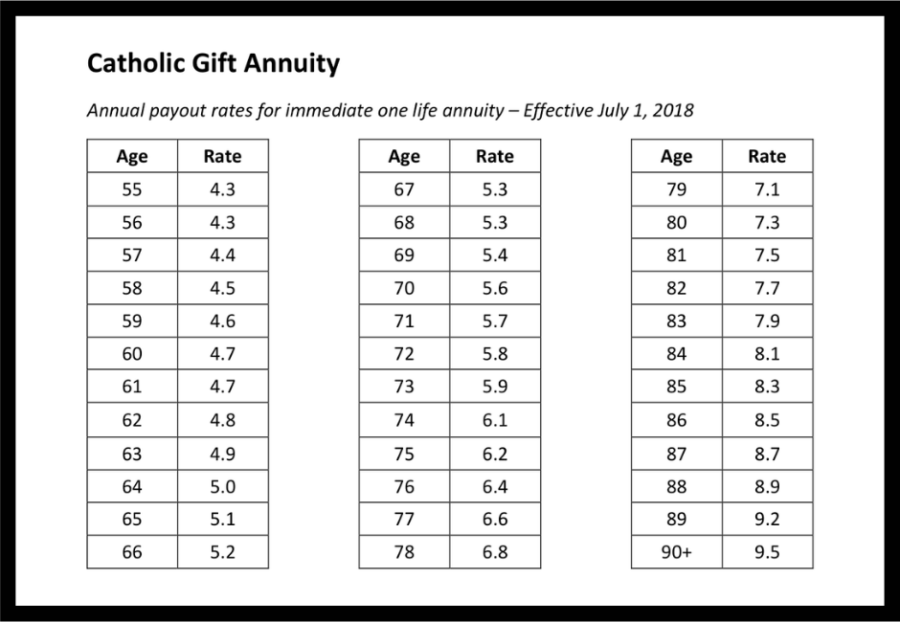

What are the current gift annuity rates.

. As of July 1 2022 Duke can offer even better annuity rates than before. Because they need continuing income they decide to give the cash in exchange for a one-life. The charitable gift annuity rates suggested by the American Council on Gift Annuities have increased.

Two Lives Joint Survivor Younger Age Older Age Rate. And once you lock in your higher rate it is yours for life no matter how the markets change in the future. Gift annuities can be funded by a variety of assets.

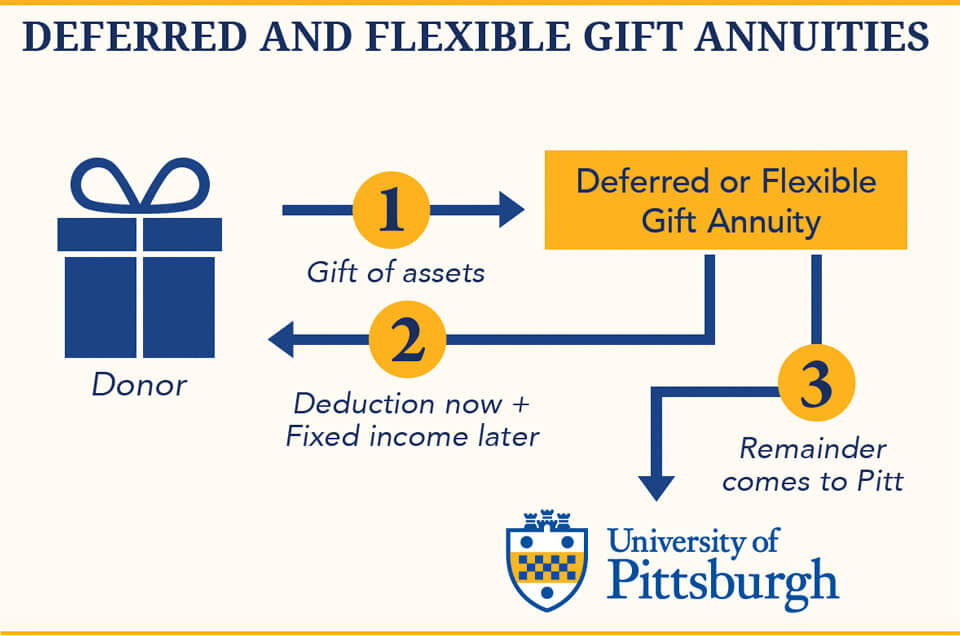

Both immediate and deferred payment annuity. A charitable gift annuity can be designed to begin paying an income stream to the donor immediately at a fixed future date or at a flexible future date providing the donor with the. 133 rows The gross annual expected return on immediate payment and deferred payment gift annuity reserves is 450.

Under the current rate schedule Mary 79 transfers 25000 in exchange for a charitable gift annuity. The suggested maximum gift annuity rates developed and monitored by the ACGA are the industry standard and are followed by 97 of charitable organizations nationwide. The principal passes to TNC after the lifetime of the income beneficiaries.

The American Council on Gift Annuities ACGA recently announced new suggested maximum charitable gift annuity rates effective July 1 2020. The payments start on a date you choose that is at least one. Increased payment rates are in effect July 1 2022.

In the spirit of leadership and with a commitment to thoughtful philanthropy we want to inform you that on July 1 the payout rates for charitable gift annuities will drop by. Charitable Gift Annuity Payment for a 10000 Gift. A charitable gift annuity could be right for you if.

The minimum amount necessary to create a gift annuity at Harvard is 25000. Charitable gift annuity rates for one person ages 81 and up. You want the security of fixed dependable payments for life.

Age Annuity rate Annual payment received Charitable deduction. The most recently published rates apply to gift annuities issued on or after July 1 2008. A charitable gift annuity provides a way for you.

Rates begin at 33 for single-life annuitants age 0 - 5 and increase to 105 for single-life annuitants. You want to save income taxes or. Our donor age 75 plans to donate a maturing 25000 certificate of deposit to AT.

The University of Minnesota Foundation will offer these higher rates for new gift. The annuity rates offered to donors by the Foundation will not exceed those suggested by the American Council on Gift Annuities ACGA although in any given instance a donor may agree. You want to maintain or increase your cash flow.

A deferred gift annuity provides fixed payments to you or others you name for life in exchange for your gift of cash or securities. SUGGESTED CHARITABLE GIFT ANNUITY RATES Approved by the American Council on Gift Annuities Effective April 26 2021. Cash appreciated securities mutual funds real estate art.

Now is a great time to consider how a gift.

New Charitable Gift Annuity Rates

Charitable Gift Annuities Uchicago Alumni Friends

Free Download How To Let Your Donors Know About The New Charitable Gift Annuity Rates

Stelter Insights Special Update New Cga Rates Released

Charitable Gift Annuity Rates On The Rise Don T Miss This Opportunity To Make A Difference University Of Maine Foundation

Gifts That Provide Income Giving To Mit

Planned Giving Gifts That Pay You Income

Charitable Gift Annuities The University Of Pittsburgh

Gift Annuity Rates Heating Up Yellowstone Boys And Girls Ranch Foundation

Charitable Gift Annuity Rates January 2020 Alabama West Florida United Methodist Foundation

Gifts That Pay You Franciscan Friars

Charitable Gift Annuity Flyer Valley Presbyterian Foundation Of Paradise Valley Az

Gift Calculator South Carolina Catholic

Charitable Gift Annuity Rates Scheduled To Change Washington State University

Charitable Gift Annuity Boys Girls Clubs Of Palm Beach County

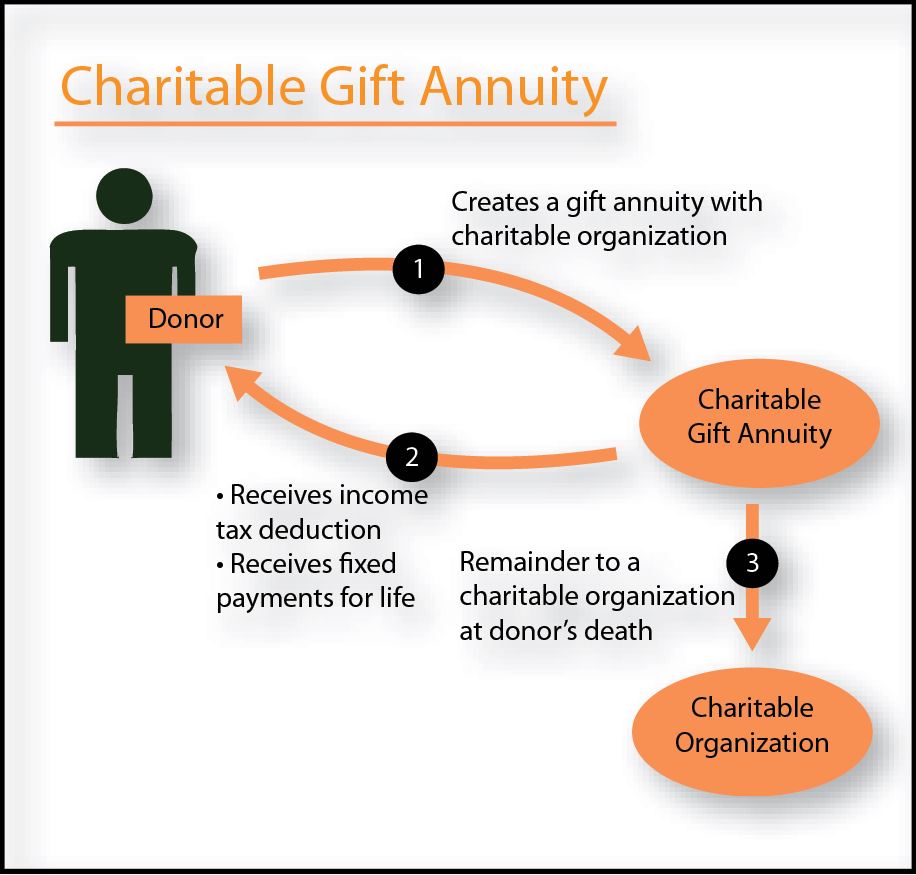

Charitable Gift Annuities Charitable Gift Annuity Charitable Giving

Spencer Sacred Heart Charitable Gift Annuities Spencer Ia

Charitable Gift Annuities Preachers Aid Society And Benefit Fund